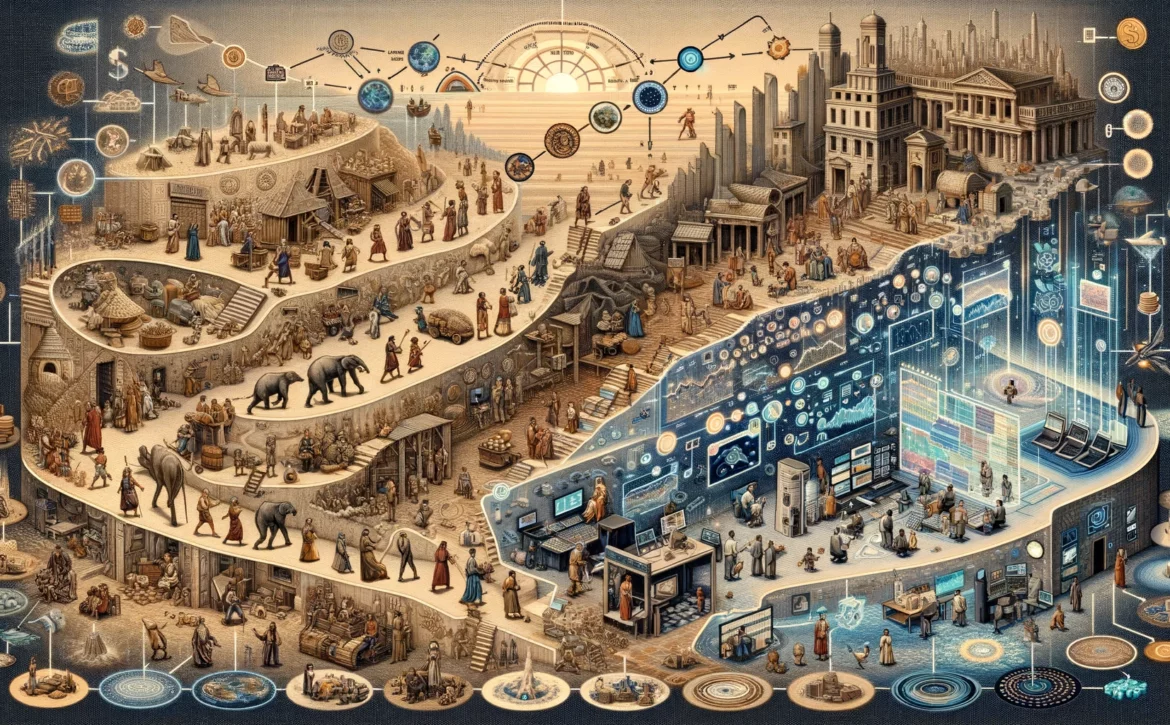

The Evolution of Investment Strategies: From Traditional to AI-Driven Approaches

The world of investment has witnessed a remarkable transformation over the decades. From traditional methods rooted in human expertise and intuition to sophisticated, AI-driven approaches, the evolution of investment strategies has been profound.

In this blog, we explore this journey, highlighting the key milestones and the significant shift towards AI-driven investment strategies.

The Early Days: Traditional Investment Methods

In the early days, investment strategies were primarily based on human judgment and expertise. Investors relied on fundamental analysis, which involved evaluating a company’s financial statements, market position, and competitive landscape. This approach required a deep understanding of industries and sectors, as well as the ability to interpret financial data and market trends.

Key Elements of Traditional Investment:

- Fundamental Analysis: Assessing a company’s intrinsic value through financial statements, earnings reports, and economic indicators.

- Technical Analysis: Analyzing historical market data, price charts, and trading volumes to predict future price movements.

- Expert Intuition: Leveraging the experience and insights of seasoned investors and financial advisors to make investment decisions.

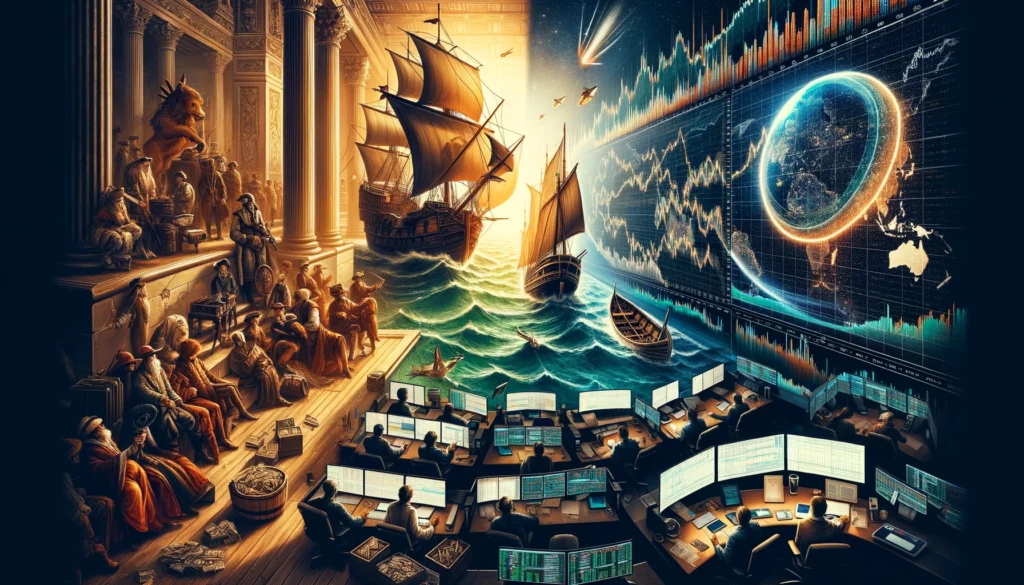

The Rise of Quantitative Analysis

As the financial markets grew more complex, the need for more sophisticated tools and techniques became evident. This led to the rise of quantitative analysis, which employs mathematical models and statistical techniques to evaluate investment opportunities. Quantitative analysts, or “quants,” use algorithms and historical data to identify patterns and make predictions.

Key Features of Quantitative Analysis:

- Mathematical Models: Utilizing statistical models to assess risk and return, optimize portfolios, and identify arbitrage opportunities.

- Algorithmic Trading: Implementing automated trading strategies that execute trades based on pre-defined criteria and market signals.

- Data-Driven Decisions: Making investment decisions based on empirical data and rigorous backtesting of models.

The Advent of AI-Driven Investment Strategies

The advent of artificial intelligence (AI) has brought a revolutionary shift in investment strategies. AI-driven approaches leverage machine learning, natural language processing, and big data analytics to gain deeper insights and enhance decision-making processes. These technologies enable investors to process vast amounts of data, identify complex patterns, and adapt to changing market conditions in real-time.

Key Aspects of AI-Driven Investment:

- Machine Learning: Using algorithms that learn from historical data to make predictions and improve over time without human intervention.

- Natural Language Processing (NLP): Analyzing news, social media, and other textual data to gauge market sentiment and uncover investment opportunities.

- Big Data Analytics: Processing and analyzing large datasets from diverse sources to identify trends and correlations that traditional methods might miss.

- Robo-Advisors: Providing automated, algorithm-based financial planning services with minimal human intervention, making investing more accessible and cost-effective.

The Benefits of AI-Driven Investment Strategies

AI-driven investment strategies offer several advantages over traditional methods:

- Enhanced Accuracy: AI algorithms can analyze large volumes of data with high precision, reducing the likelihood of human errors and biases.

- Real-Time Adaptation: AI systems can continuously learn and adapt to new market information, making them more responsive to changes.

- Scalability: AI-driven approaches can manage and optimize vast portfolios efficiently, enabling better diversification and risk management.

- Cost Efficiency: Automation reduces the need for human intervention, lowering operational costs and making investment services more affordable.

The Future of Investment Strategies

The evolution of investment strategies is an ongoing process, with AI expected to play an increasingly prominent role. As AI technologies continue to advance, we can anticipate even more sophisticated tools and techniques that will further enhance investment decision-making.

Emerging Trends:

- Predictive Analytics: Leveraging AI to forecast market trends and economic indicators with greater accuracy.

- Personalized Investment Strategies: Using AI to tailor investment portfolios to individual preferences, goals, and risk tolerances.

- Ethical and Sustainable Investing: Employing AI to evaluate companies based on environmental, social, and governance (ESG) criteria, aligning investments with personal values.

Conclusion

The evolution from traditional to AI-driven investment strategies marks a significant leap forward in the world of finance. By embracing these advanced technologies, investors can unlock new opportunities, manage risks more effectively, and achieve better outcomes.

As we look to the future, the integration of AI in investment strategies promises to make investing more intelligent, efficient, and accessible for all.

Learn More