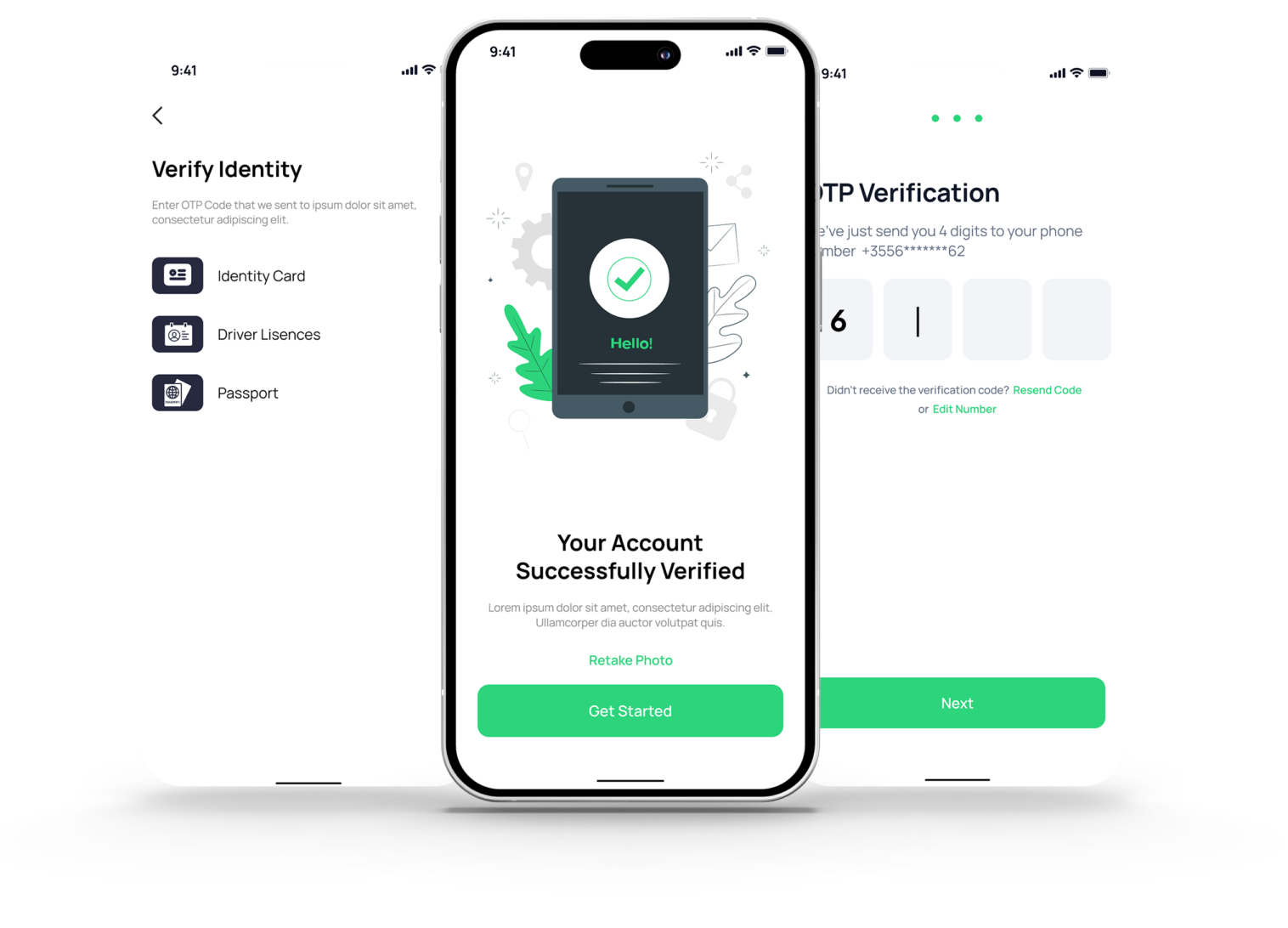

Ensuring compliance with KYC and AML regulations is more than a legal obligation—it’s a commitment to the safety of your customers and the integrity of your fund.

Implement rigorous KYC & AML checks with ease, using FinqUP

Our partnership with IDnow ensures that your fund meets the

highest standards of KYC and AML compliance.

Experience secure, reliable, and efficient identity

verification for your users.